WARNING: Vaping products contain nicotine, a highly addictive chemical. Health Canada

WARNING: Vaping products contain nicotine, a highly addictive chemical. Health Canada

⚠️ Shipping Update: Canada Post Strike — Alternate Carriers Now in Use. For More Information, Click Here. ⚠️

Due to the strike, some online packages may be delayed. We’re still shipping daily, and if your package is affected, we’ll work with you to make it right.

📦 Free Shipping On Orders Over $100 📦 $10 Flat Rate Shipping Under $100 within BC

🚚 Same Day Delivery Now Available In The Greater Vancouver Area 🚚

🚨 Discount Automatically Applied In Cart. No Coupon Code Needed! 😍

SHOP FREEBASE BY FLAVOUR

SHOP CLEARANCE

SHOP BY BRAND

SHOP NIC SALT BY FLAVOUR

SHOP CLEARANCE

SHOP BY BRAND

# TO D

SHOP DISPOSABLES BY PUFF COUNT

SHOP DISPOSABLES BY FLAVOUR

SHOP CLEARANCE

SHOP BY BRAND

SHOP VAPE PODS BY FLAVOUR

ALLO & STLTH COMPATIBLE

SHOP CLEARANCE

SHOP BY BRAND

RUFPUF KLIKIT

Springtime SP2S

SHOP BY TYPE

POD BASED SYSTEMS

COIL BASED SYSTEMS

SHOP BY TYPE

VAPE/BOX MODS

SHOP CLEARANCE

ACCESSORIES

Batteries & Chargers

Wires Parts & Tools

DRY HERB VAPORZERS

GLASS FOR HERB/CONCENTRATES

SHOP BY BRAND

HEATED TOBACCO

POUCHES

IQOS ILUMA

IQOS TEREA Sticks

HEATED TOBACCO

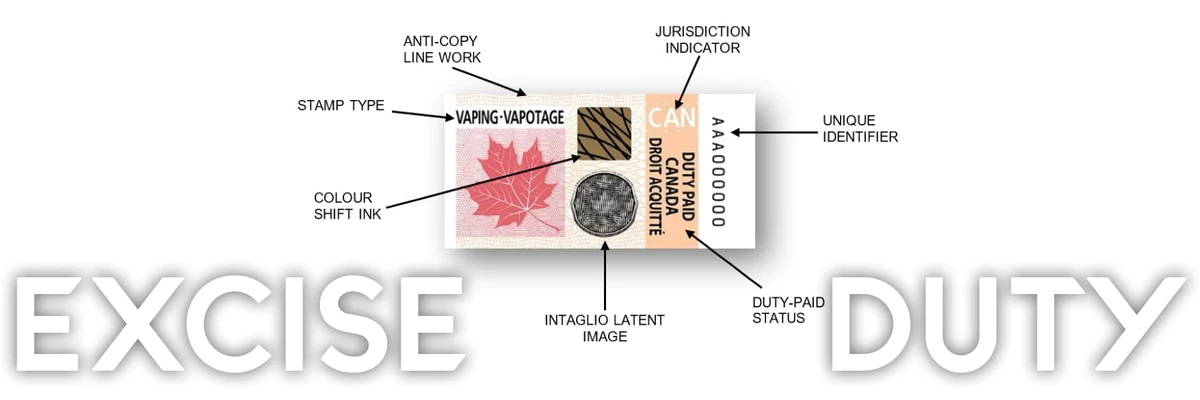

With the Canadian Governments' introduction of Excise Stamps to Vaping, the cost of all Vaping Products containing e-liquid will be going up. This includes Disposables, Pre-filled Pods and all Bottles of E-liquid — regardless of the amount, type or presence of Nicotine.

Starting Jan 1 2023, the government is implenting a new duty tax on all nicotine products. The tax will increase as follows:

| Product | Tax Increase |

|---|---|

| 2ML DISPOSABLES | + $1 INCREASE |

| VAPE PODS | + $1 INCREASE PER POD |

| 30ML E-JUICE | + $7 INCREASE |

For more information regarding the Vaping Excise Tax:

click here